Tesla (TSLA) is about to release Q2 2024 financial results on Tuesday, July 23, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll take a look at what both the street and retail investors are expecting for the quarterly results.

Tesla Q2 2024 deliveries

While Tesla is an “AI/robotics” company, according to CEO Elon Musk, its automotive deliveries remain the biggest drivers of financial performance by far.

Tesla already disclosed its Q2 vehicle delivery and production numbers:

| Models | Production | Deliveries | Subject to operating lease accounting |

| Model 3/Y | 386,576 | 422,405 | 2% |

| Other Models | 24,255 | 21,551 | 1% |

| Total | 410,831 | 443,956 | 2% |

Deliveries are down year-over-year for the second quarter in a row, but the performance was much better than last quarter.

Tesla has also already disclosed an impressive new record deployment of energy storage at 9.4 GWh.

Tesla Q2 2024 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers.

However, Tesla’s average price per vehicle is changing a lot these days due to frequent price cuts and discounts across many markets, which makes things more difficult.

This quarter, Wall Street also has to account for the record energy storage, which is adding billions of dollars to revenue.

The Wall Street consensus for this quarter is $24.380 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $24.562 billion.

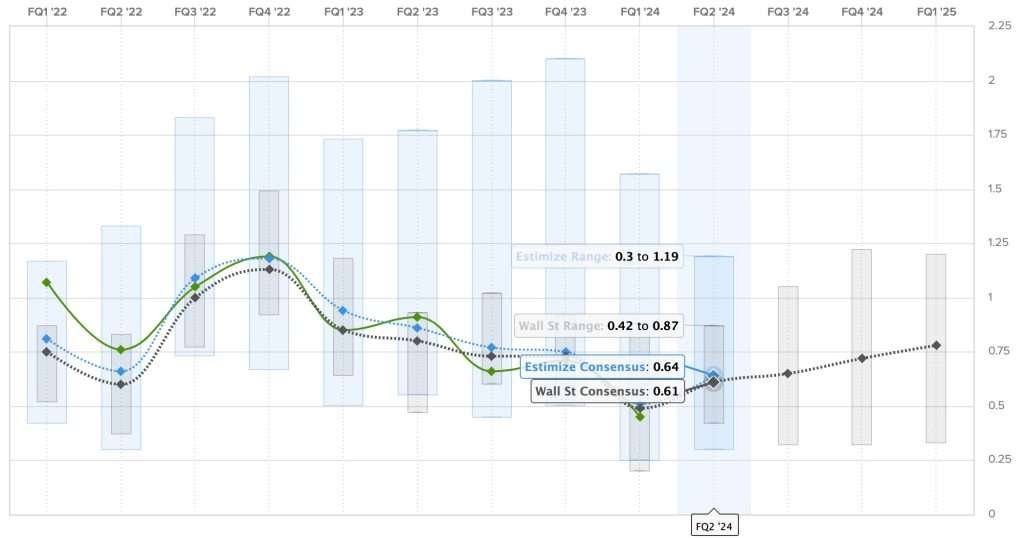

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

Tesla Q2 2024 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last three years now.

However, like revenues, it has been harder to estimate earnings over the last year with price cuts digging into Tesla’s industry-leading gross margins and the lower deliveries are making it harder.

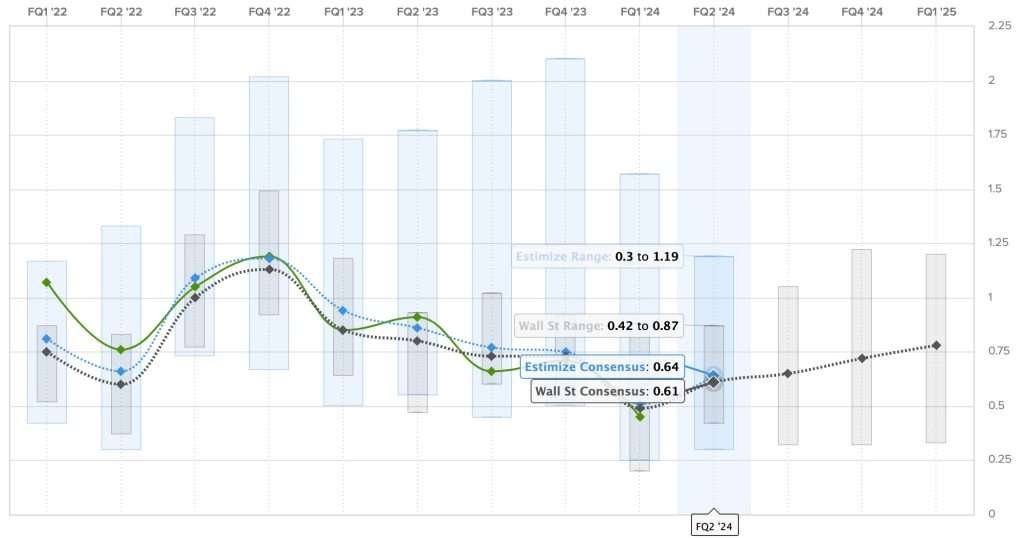

For Q2 2024, the Wall Street consensus is a gain of $0.61 per share, while Estimize’s prediction is slightly higher with a profit of $0.64 per share.

Tesla had earnings of $0.91 per share during the same period last year.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Other expectations for the TSLA shareholder’s letter and analyst call

Beyond the financial results, Tesla always gives broader updates and answers shareholder questions in its shareholder letter and conference call with management following the release of the results.

Tesla gathers questions from shareholders from the “Say Technologies” website.

Here are the currently most upvoted questions likely to be answered by management:

- When exactly is the robo taxi event if not 08/08

- When do you expect the first Robotaxi ride?

- What are Tesla’s 2 biggest priority for next 5 years?

- What is the current status of 4680 battery cell production and how is the ramp-up progressing?

- When do you expect Optimus to be available for purchase?

I have to say that these are terrible questions, but it’s not too surprising considering where Tesla shareholders are today. They are virtually all about Tesla’s program delays, and they have all been answered somewhat recently.

If you want to focus on the positive, I’d ask about the state of energy storage gross margin amid the new record deployment. That would make a big difference.

But I think the most impactful part of the earnings could end up being a guidance change for the year. With the first two quarters being down year-over-year, there’s a risk that Tesla might not be able to turn things around in the second half of the year and it would have to adjust guidance for the year.

Tune in after market close for our coverage of the shareholder’s letter and the conference call.

FTC: We use income earning auto affiliate links. More.

Source link

#Tesla #TSLA #earnings #preview #expect #today