Tesla is now distinguishing its cars between battery suppliers in order for people who are eligible for the tax credit to get it.

Electric vehicle manufacturers in the US are still adapting to the increasingly more stringent rules of the $7,500 federal tax credit for electric vehicles.

The increased requirements for more battery material and component sourcing have shuffled the eligibility of some vehicles, and for Tesla vehicles, it can change depending on the trim.

We recently noted that Tesla managed to get its Model 3 Long Range to get access to the full tax credit. Prior to that, its generally more expensive Performance variant would cost less due to access to the tax credit.

Now, Tesla has come up with an interesting solution to optimize the use of the cells so that more people can get access to the credit.

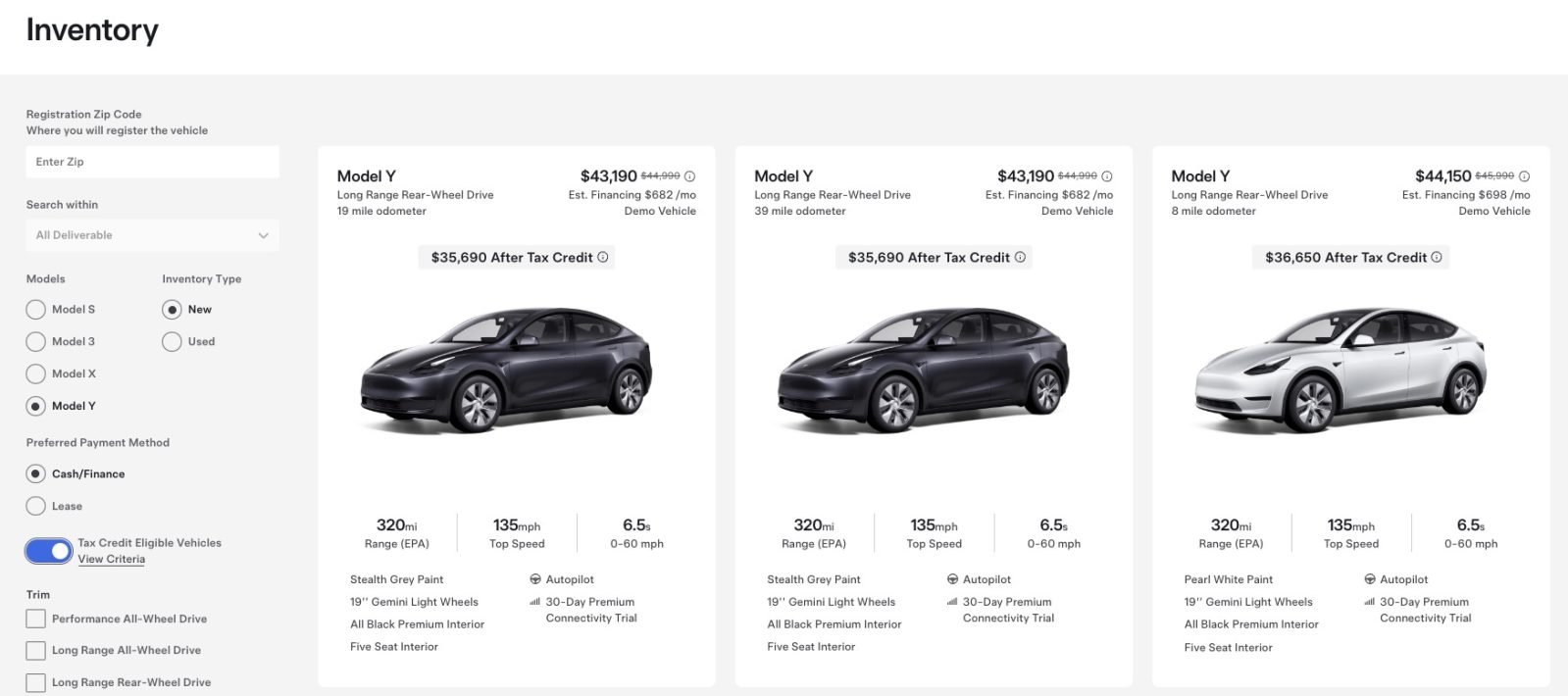

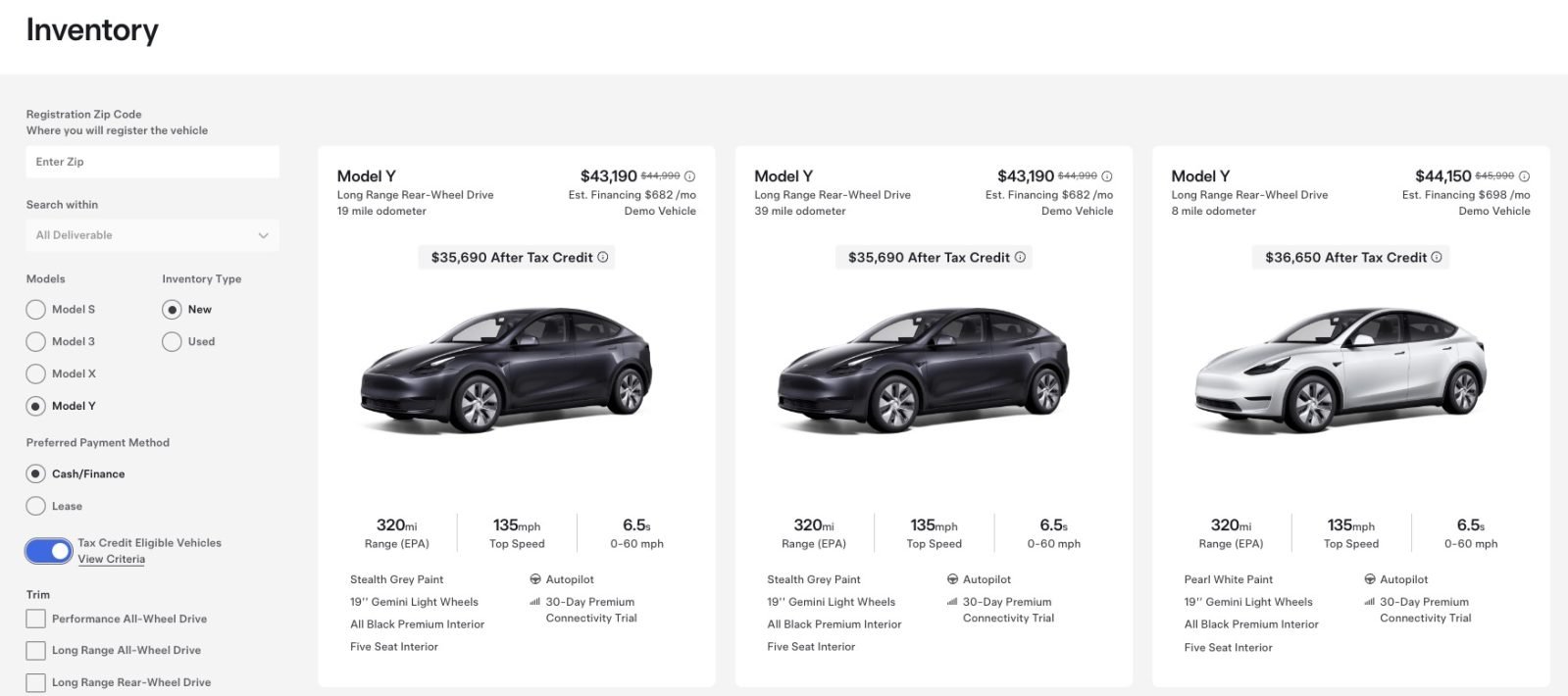

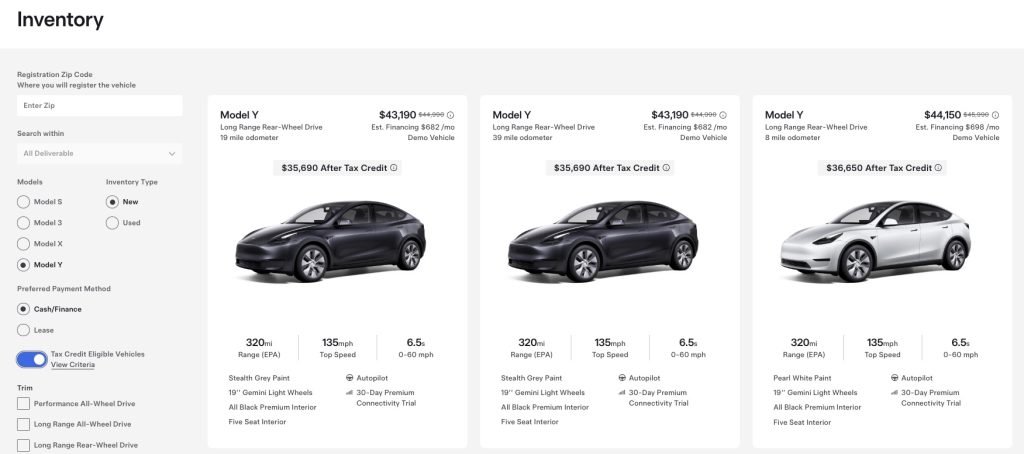

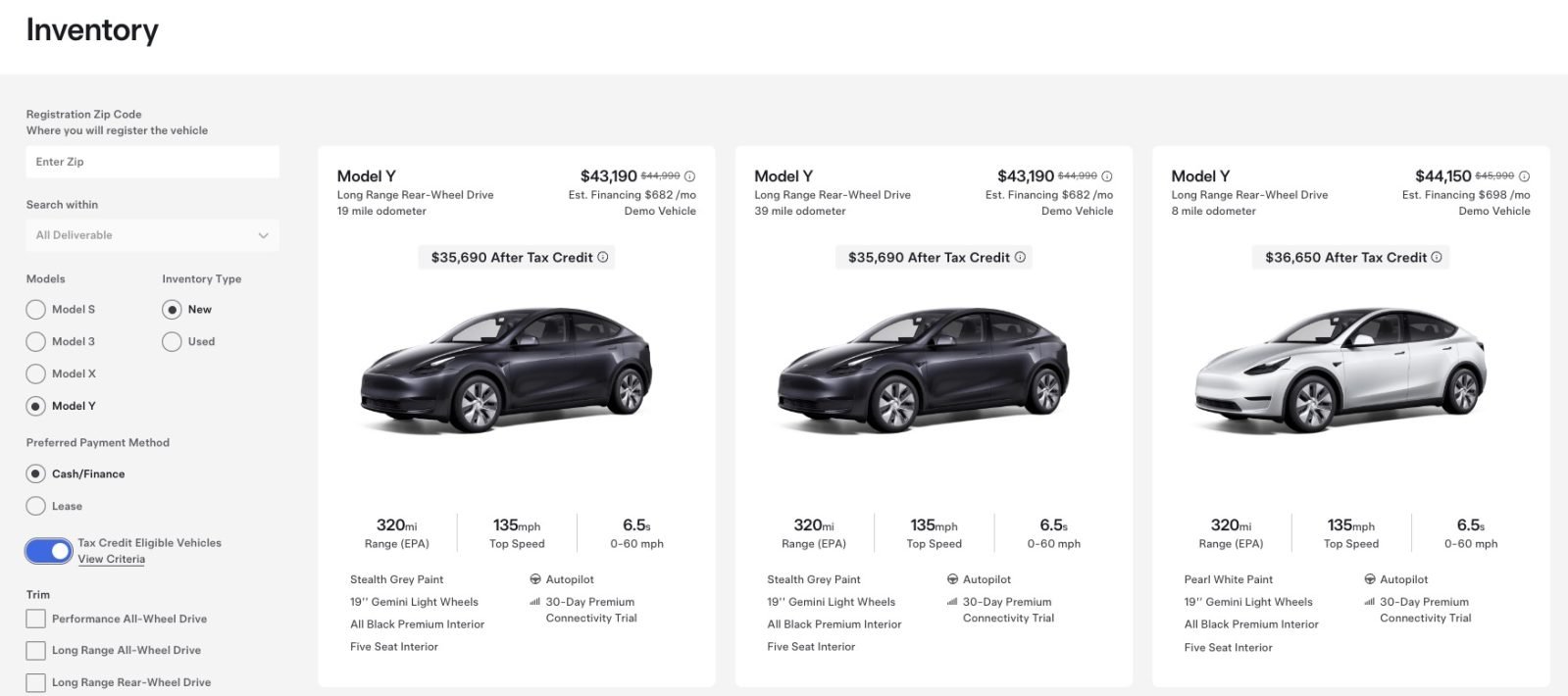

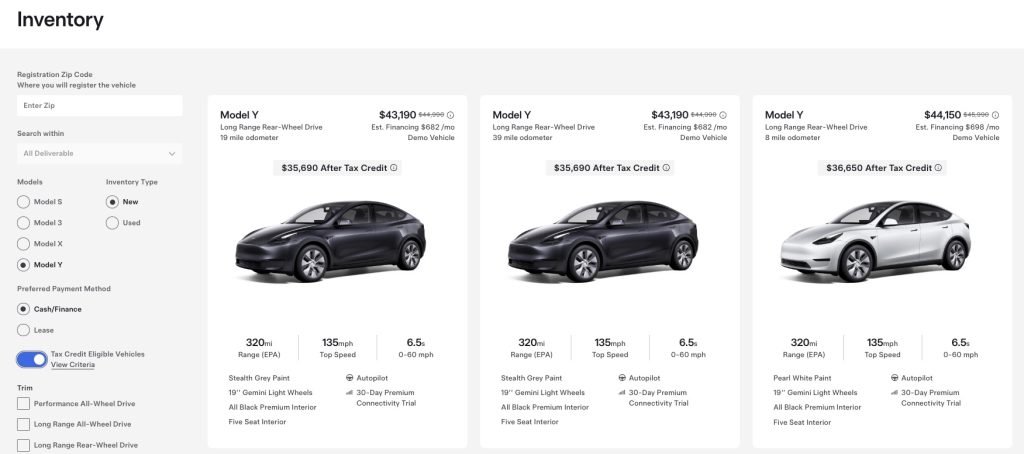

On its inventory page, Tesla has now added a new toggle for ‘Tax Credit Eligible Vehicles’:

What this toggle does is distinguish vehicles with Panasonic cells, which are eligible for the tax credit, rather LG cells, which are not.

This makes sense because the vehicle and the buyer need to be eligible. The eligibility criteria for buyers are $150,000 in individual income or $300,000 for dual filers.

If you don’t fit those criteria, it makes sense to get a car that doesn’t have those cells since you won’t get the credit anyway.

Electrek’s Take

This is a great idea to optimize access to the tax credit. However, it leaves people who are not eligible with a choice because, technically, the Panasonic cells are a little more desirable even without the credit.

They are known to charge a little faster than the LG cells.

It’s not a huge difference, but it’s something that people should at least know about before buying.

FTC: We use income earning auto affiliate links. More.

Source link

#Tesla #distinguishes #cars #battery #suppliers #tax #credit #eligibility