The world’s first electric muscle car is finally here, and Dodge is already sweetening the deal for buyers. The Dodge Charger Daytona EV is launching with 0% APR, making it even cheaper to finance than the outgoing gas-powered model. Lease prices for the electric Charger start as low as $549 per month, but the Hellcat-like Scat Pack model may be an even better deal.

Dodge Charger EV launches with 0% APR offer

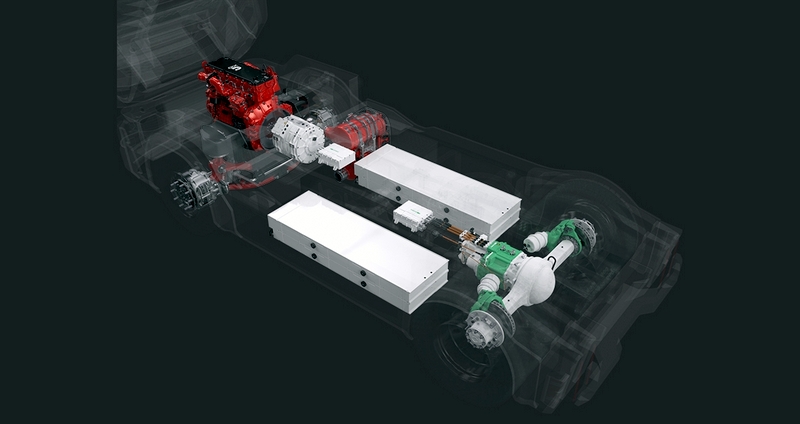

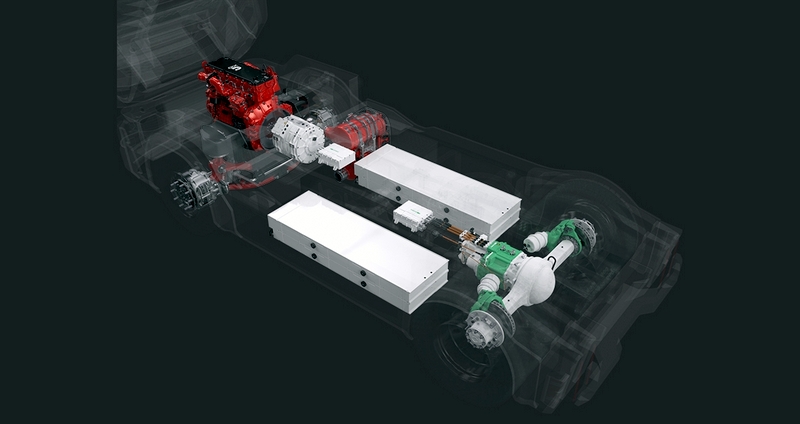

The first all-electric Dodge Charger has arrived, and surprisingly, it’s already becoming more affordable. In March, Dodge unveiled the Charger Daytona EV, kicking off “the next generation of Dodge muscle.”

According to Dodge brand CEO Tim Kuniskis, the electric Charger “delivers Hellcat Redeye levels of performance.” That’s for the Scat Pack model, which comes with a Direct Connection Stage 2 upgrade kit straight from the factory.

The upgrade delivers up to 670 hp and 627 lb-ft of torque for a 0 to 60 mph sprint in just 3.3 seconds. It can also cover a quarter mile in around 11.5 seconds.

In comparison, the 807 hp Dodge Charger SRT Redeye Jailbreak edition, powered by a Supercharged 6.2L HEMI SRT V8 engine, takes 3.6 seconds to get from 0 to 60 mph.

With a Stage 1 upgrade, the base R/T trim has up to 456 hp and 404 lb-ft of torque, good for a 0 to 60 mph time in 4.7 seconds.

Dodge opened orders for the 2024 Charger Daytona EV in September, starting at $59,995. The High-performance Scat Pack trim starts at $73,190.

According to a new dealer note viewed by online auto research firm CarsDirect, all 2024 Dodge Charger Daytona EV models are now eligible for 0% APR financing for up to 72 months.

| 2024 Dodge Charger Daytona EV trim | Horsepower | 0 to 60 mph time | Starting price |

| Dodge Charger Daytona R/T | 496 hp | 4.7 seconds | $59,995 |

| Dodge Charger Daytona Scat Pack | 670 hp | 3.3 seconds | $73,190 |

The offer makes the electric Dodge charger even cheaper to finance than the outgoing 2023 Dodge Charger at 5.9% APR for the same 72 months. However, this is an individual offer and cannot be combined with other deals. Based on CarsDirect analysis, the 0% APR offer is limited to the Northeast, Southern, and Central US regions.

Dodge is also offering a $1,000 loyalty bonus for Stellantis (Jeep, Dodge, Ram, Chrysler) lessees that trade in for the electric Charger.

Update 11/26/24: The 2024 Dodge Charger Daytona EV launches with lease prices starting at $549 for 36 months. With $4,999 due at signing, the effective rate is $688 per month (10,000 miles per year).

Although it may not seem cheap, it’s a pretty good deal for a $60,000 electric muscle car. According to CarsDirect analysis, the outgoing Challenger R/T has an effective cost of at least $853 per month. And that’s with an MSRP of just $43,235. The EV model is nearly $20,000 more on paper but significantly less to lease than the aging 2023 model.

Meanwhile, the Scat Pack model may be an even better deal. With a lease money factor as low as 0.00006 on a 24-month lease, the Scat Pack trim is surprisingly lower than the lease rate of 0.00027 for the base R/T model.

It also has a higher residual value. On a 24-month lease, the Scat Pack trim has a 59% residual compared to the R/T’s 54%. With both trims eligible for a $7,500 lease incentive, the high-performance model could be an even better deal.

With the $7,500 EV tax credit incentive, eligible customers can save up to $8,500 on the 2024 Dodge Charger Daytona EV. You may want to act fast, as these deals expire on December 2, 2024.

Jeep, another Stellantis brand, launched lease prices at just $599 per month for its first luxury electric SUV last week, the Wagoneer S. Jeep’s electric Wagoneer is also available with 0% financing.

Ready to check out the world’s first electric muscle car for yourself? We can help you get started today. You use our link to find deals on 2024 Dodge Charger Daytona models at a dealer near you.

Source link by Electrek

Author Peter Johnson

#Dodge #Charger #cheaper #finance #gas #model #APR #Update

![Dodge Charger EV is even cheaper to finance than the Dodge Charger EV is even cheaper to finance than the gas model with 0% APR [Update]](https://ev-magazine.com/media/2024/11/1732668187_Dodge-Charger-EV-is-even-cheaper-to-finance-than-the-696x364.jpeg)