Those holding out for a cheap $20,000 EV from China might want to look for a third-party Presidential candidate who’s on board with free trade.

The Biden administration on Tuesday took a serious protectionist stance, revealing sweeping tariff hikes affecting $18 billion of Chinese imports, with electric vehicles and their supply chain at the core.

The scope of the 100% tariff hike announced on EVs wouldn’t at face value provide the same trade barrier as the 100% tariff on Mexico-built Chinese cars—EV or not—that former President and Presidential candidate Donald Trump had proposed in March. But it goes after key aspects of the EV supply chain in ways that will affect new vehicles no matter what fuel they have.

Officially, up to today, cars imported from China are only subject to a 25% tariff, while those made with Chinese parts in Mexico would only be subject to a 2.5% tariff—so it is effectively a loophole that Chinese companies like BYD might be able to exploit to get a foothold in the U.S. market.

UAW-made sticker on 2022 Chevy Bolt EV

Ironically, U.S. automakers have nothing like the affordable EVs that Chinese companies might try to bring to the U.S. The Chevrolet Bolt EV had a sticker price well under $30,000 and was U.S.-made, fully qualifying for the EV tax credit, but GM discontinued it last year and a replacement model won’t arrive for another year.

Preempting an EV invasion already happening in Europe

As an example of the threat from China, the well funded, global automaker BYD, for instance, now sells the Dolphin EV, a well-rated compact hatchback, in some markets in Europe for the equivalent of about $30,000. BYD’s even lower-priced EV, the Seagull, might be able to meet U.S. requirements for $20,000 or less—but the new 100% tariff is surely a deterrent.

BYD Dolphin EV – Euro spec

Specifically, tariffs on electric vehicles rise from 25% to 100% this year. The hikes aren’t just on finished EVs, but on critical elements of the supply chain. This year, the tariff rate on lithium-ion batteries and battery parts increases from 7.5% to 25% when applied to EVs, while an equivalent hike on lithium-ion batteries imported from China for other purposes will apply starting in 2026.

The tariff hikes aren’t on everything, but they apply to “strategic sectors,” according to the Biden administration, that closely parallel the investments made by the administration. That includes steel and aluminum, semiconductors, EVs, batteries, critical minerals, solar cells, cranes used at ports, and medical products.

China currently controls more than 80% of some aspects of the global EV battery supply chain, the administration says, which leaves national security at risk, among other concerns.

Electric or not, the Biden tariffs will prompt automakers to think twice about Chinese sourcing. Chinese steel and aluminum products will, for instance, get a 25% tariff this year, up from 7.5%, and semiconductors will get a 50% tariff in 2025, up from 25% today.

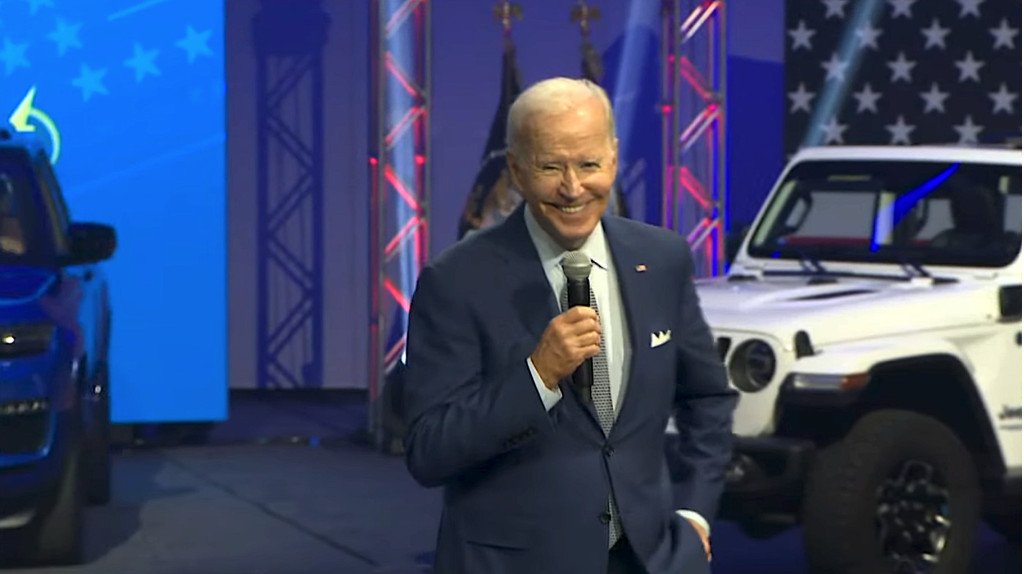

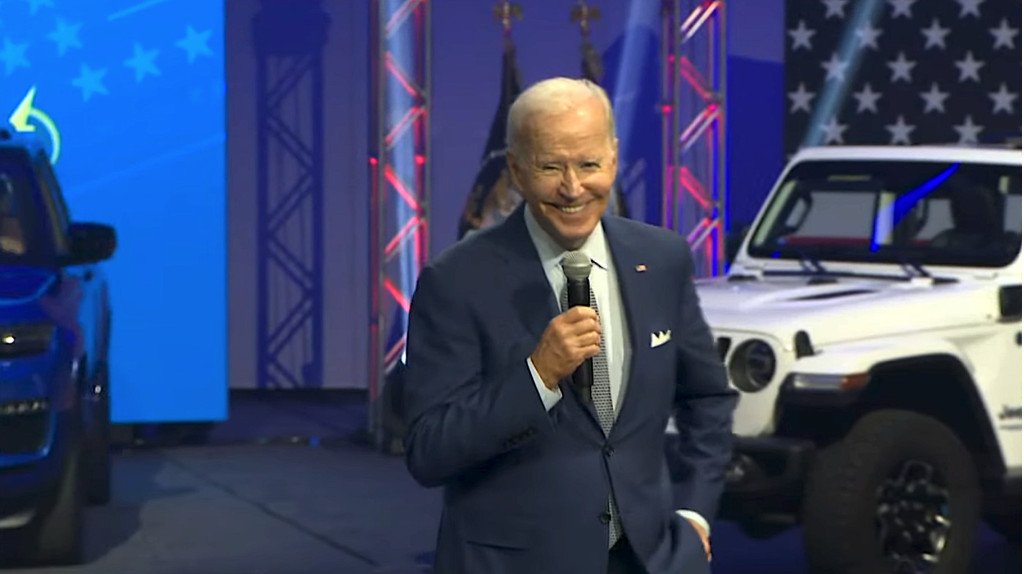

President Biden at 2022 Detroit Auto Show

“As President Biden says, American workers and businesses can outcompete anyone—as long as they have fair competition,” said the Biden administration, in an announcement of the sweeping tariff hikes. “But for too long, China’s government has used unfair, non-market practices.”

The administration then points to the technology transfers and intellectual property theft that have created “unacceptable risks to America’s supply chains and economic security,” noting that China’s current state of overcapacity could lead to export surges of low-priced vehicles that would harm American workers.

Earlier this month the Biden administration also released a revised set of regulations that would effectively allow automakers more time to cut China out of the EV supply chain without penalizing them on EV tax credit qualification in the meantime.

President Donald Trump (Photo courtesy Gage Skidmore/Wikimedia Commons)

The series of politically motivated squeezes of trade levers might not be over, though. Since this past weekend, seemingly in an effort to one-up Biden, Trump has promised a 200% tariff against China.

Mexico remains a potential loophole

What remains to be seen—and a key difference between potential administrations—might relate to what happens south of the border. According to the Wall Street Journal, in a query of U.S. Census Bureau data covering 2023 and 2024 through March, Mexico ranks third in electric vehicle imports to the U.S. after Germany and South Korea, while Japan and Belgium round out the top five. Imported EVs—including those from China—whether or not they comply with stricter EV tax credit sourcing requirements, still receive up to a $7,500 incentive when they’re leased.

Under the previous Trump administration, the U.S.-Mexico-Canada Agreement replaced NAFTA with stricter trade terms but effectively still allowed products to flow from Mexico tariff-free.

The Biden tariffs do little to assure that a Chinese internal combustion vehicle—even a hybrid, for instance—might not be assembled in Mexico and then shipped north. Beyond EVs, that may be a serious test of trade rules, and the industry, yet to come.

Source link

#Biden #hikes #tariffs #Chinese #EVs